After a slow start at the first half of 2019, the real estate market in Greater Vancouver seemed to be picking up in the summer. In October, home sales were 9.8% above the 10-year October sales average.

In November, home sales dropped to 4% below the 10-year November sales average as the holiday season is approaching.

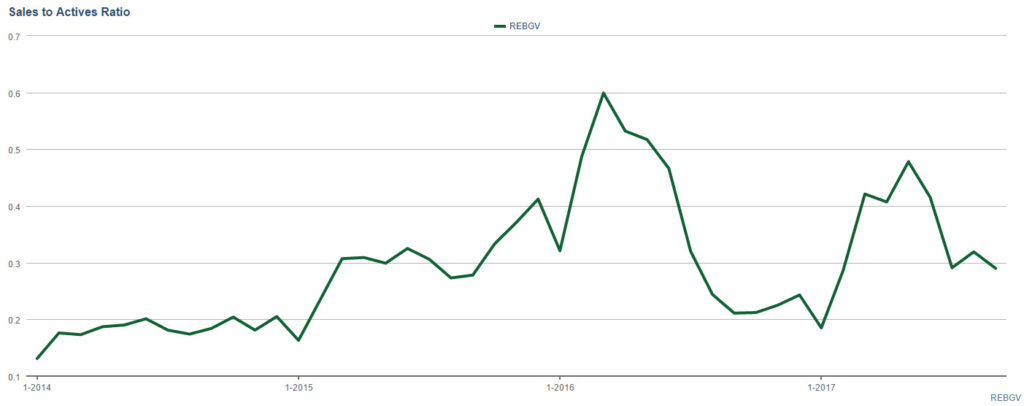

If we look at supply and demand, the sales-to-active-ratio for all property types had increased enough in October to push the single family house market in Metro Vancouver from a buyer’s market at the beginning of the year to a balanced market since October 2019. For both townhomes and condominiums, the market had returned to seller’s market from a balanced market although the prices were not as high as last year.

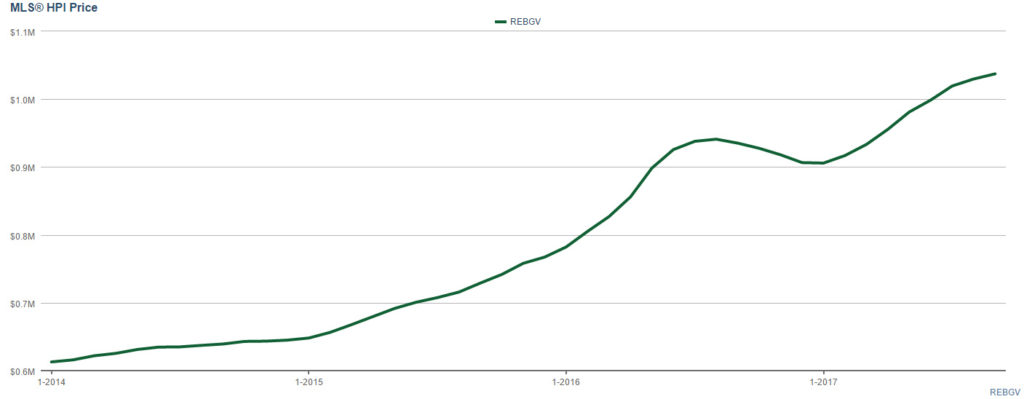

The implementation of the speculation tax, the more stringent mortgage stress test, restriction on farmland build-able square footage and continued tightening of money coming out of China were the many government and international factors that held off buyers at the sidelines at the beginning of this year. As a result, we see home prices drop about 10% across the board. The big banks started to market promotional interest rates to attract buyers.

Since summer 2019, we see buyers coming back into the real estate market.

“Home buyers have more confidence today than we saw in the first half of the year,” says Ashley Smith, REBGV president. “With prices edging down over the last year and interest rates remaining low, hopeful home buyers are becoming more active this fall.”

Another interesting trend we see is that the home price index for condominium is in line with single family houses in 2019 (see graph below). The condo market has been so hot for so long while the detached home market has been slow for several years. As a result, the price of condo is catching up to the price of single family home. It might be a great opportunity for condo owners to upgrade to single family houses. Or simply a great time to buy detached homes. For example, someone with a condo in Vancouver may be able to sell it and buy a single family home in the suburbs like Richmond or Burnaby.

Click on the links below to see some predictions for the coming year in real estate:

B.C. housing market to stabilize in 2020, accelerate in 2021: federal report